Will rising interest rates dampen enthusiasm for collector cars?

Fed chair Jerome Powell likely has too much on his plate right now to worry about old cars, assuming he ever did. But we, of course, worry about little else. So, with the Fed hiking interest rates to fight inflation, it’s high time to determine which vehicles are most likely to be financed with a loan.

There are two concerns here. The first is that, as lending rates rise, vehicles that tend to be financed are more likely to lose value as demand declines. This is, in essence, the same concern you’re hearing throughout the economy—that the Fed’s efforts to cool demand might work too well. The larger worry is that if a significant portion of collectors have borrowed money to buy their cars, they’ll be in a hole should values dip and, perhaps, find themselves forced to sell to keep banks happy. That’s the sort of thing can turn a “correction” into a catastrophe, the likes of which the collector car market experienced in the early 1990s and which the broader economy went through in 2009.

We won’t leave you hanging in suspense here: That house-of-cards scenario does not exist in today’s collector car market. Only 3.8 percent of the cars in Hagerty’s book of insurance business are financed. That’s compared to more than a third of used-car purchases in the United States, according to Statista.com. The share is even lower for classics older than 25 years. These are reassuring numbers, and they correspond with what we’ve heard from industry insiders. Collectors overwhelmingly own their cars outright.

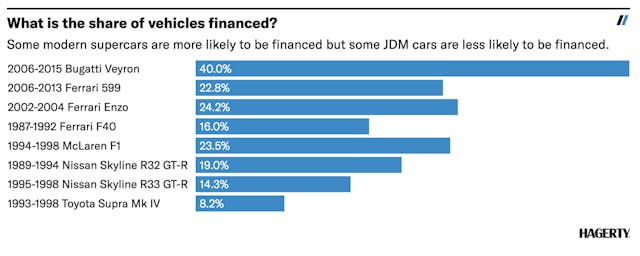

Some vehicles, of course, come in higher than that overall average. No surprise, most of them are newer. The surprising king: The Bugatti Veyron. Nearly 40 percent of the ones on Hagerty policies are financed. For its predecessor as world’s fastest car—the McLaren F1—the figure is 23.5 percent. Curiously, the share of Veyrons financed is unchanged since 2019, while the share for the F1 dropped from 33.3 percent over the same period. More than a third of the latest Ferraris Hagerty insures, such as the F8, Roma, and SF90 also carry loans, as do about one in five C8 Corvettes, Porsche 992-generation 911s, newer Vipers, and Bentley Continental GTs. Notably, fewer than 1 in 13 Ford GTs carry a loan—and that share has dropped since 2019.

On the whole, these are all low numbers considering that some 85 percent of new cars in the United States are financed.

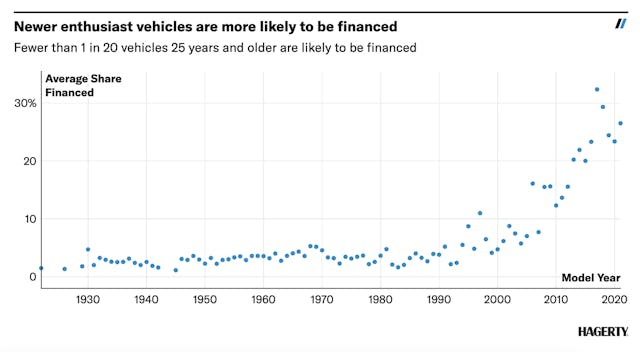

The share of financed vehicles quickly drops as vehicles age and levels off below five percent for most model years between 1960 and 1994. For some model years in the 1920s and 1930s, less than two percent of vehicles are financed.

We paid particular attention to vehicles that have appreciated sharply in recent months and that appeal to younger enthusiasts. You might assume millennials, who have less wealth on hand, might be compelled to borrow money to seize the tantalizing opportunity of a fast-rising “investment.” That assumption would be wrong. Take the 1989–94 Nissan Skyline R32 GT-R, a poster child of both youth appeal and rising values. Fewer than 1 in 5 are financed—and that share has dropped since 2019. Its successor, the R33 GT-R, has a lower financed rate of just 1 in 7. The 1993-1998 Toyota Supra Mk IV is nearly half as likely to be financed at just 1 in 12, and that rate has dropped since 2019, too. Perhaps those young enthusiasts, who entered the workforce around the time the banking sector was melting down, learned a thing or two about the risks of borrowing.

Just about everywhere we looked, the story was the same. Fewer than 1 in 12 Vipers, which have been tearing up record books, have loans. Among other popular vehicle generations such as early Camaros, Mustangs, and air-cooled 911s, the share with a loan is often between 4 and 6 percent.

Let’s not pretend that collector cars, based on this data, are immune from the potential impacts of rising interest rates. If the Fed’s efforts to curb inflation go overboard and set off a recession, enthusiasts might be less keen to splurge on the car they’ve always wanted, and appreciation could slow. Yet what our data can tell us is that collector cars are well prepared to weather any economic storm that comes.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.