8 lessons we learned at Amelia Island 2021

The 2020 Amelia Island auctions concluded just days before most of the country went into its initial lockdown. Those of us who attended remember it as a place of many “lasts”: Last crowded car event, last flight on a major airline, last handshake, last carefree drink with colleagues. It was fitting then, that the 2021 edition marked for many of us a return to something resembling normalcy—the first large, in-person concours and auctions many of us have attended since getting vaccinated. The sales, which earned $62.7 million in two days, served as both a reminder of how halting the return to normal will be and—at least in the strictly financial sense—a glimpse of how the collector car market has actually gained ground in the past year. Here’s what we learned.

We’re still not completely back

One could not help but note the usual players who were absent, including Russo and Steele and Gooding & Company, the latter of which held an online-only sale that grossed $16.1M (not included in our Amelia total). The auction scene was left to Bonhams, which held its auction on its traditional day on Thursday, and RM Sotheby’s, which maintained its sale on Saturday. There were also 57 fewer cars—down 22 percent—compared to last year.

Smaller might be better

Total sales increased 9.6 percent from last year, on the back of a much higher average price—up 37 percent from $252,909 to $346,283. (It’s worth noting that the 2020 auctions, despite their poor timing, performed about as well as they had in 2019.) The increase continues the trend we’ve seen since January of auctions earning more money on fewer cars.

In the broad sense, the combination of strong demand and somewhat constricted supply seems to echo what we’re seeing in many sectors of our reopening economy, from the housing market to new cars. In the narrow collector car sense, it represents a right-sizing of a sort from the end of the last decade, when one of our chief concerns was that in-person auctions were offering more cars than the market could absorb. “Too many auctions, too many cars,” became something of a mantra among market insiders. That seems to be fixed. Be it because auction companies have taken the pandemic pause as an opportunity to reset expectations or because it’s still tough to attract consignments (or a combination of the two), we’re clearly seeing smaller but more successful sales.

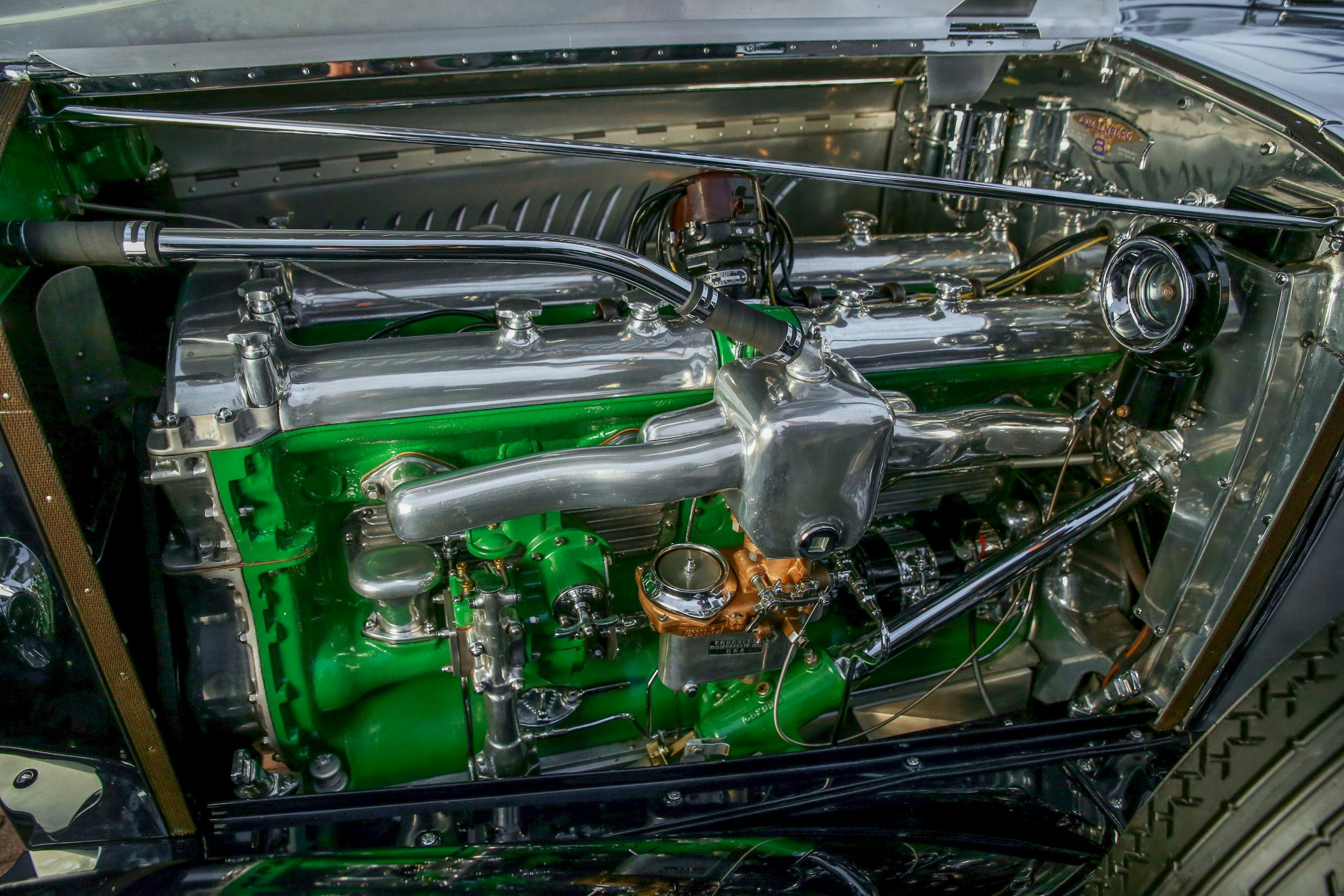

Prewar cars can still earn big bucks

The prewar segment has been somewhat underrepresented in the past year (although Bring a Trailer did just sell its first Bugatti), but they were out in full force at Amelia. More than a third of the cars on offer were built before World War II, up from a quarter last year. The top sale at Bonhams was the 1934 Mercedes-Benz 500K Sindelfingen Roadster, which sold for $4.9M. RM Sotheby’s biggest sale was a 1929 Duesenberg Model J Murphy Torpedo Convertible Coupe that brought $5.725M. That’s a marked contrast from last year when RM’s biggest sale was a 2003 Ferrari Enzo.

Amelia Island may, in this sense, show the beginning of a new trend in which live auctions held in conjunction with concours will thrive on the traditional segments of the collector car market while bigger auctions and online auctions push into new segments.

Ferraris should have stick shifts

OK, we thought that before the Amelia auctions. But last week’s sales provided more confirmation. We saw a record price for a 1995 F50—$3,772,500—and for a 2007 599 GTB, which sold for $693,000. The 599 was one of just 30 built with a manual and continues the trend of stick-shifts bringing huge premiums on newer Ferraris. Perhaps the factory will get the message?

Move over, Porsche (kind of)

Amelia is typically Porsche heaven, but this year another Stuttgart company, Mercedes-Benz, seems to have been the belle of the ball. Of the 14 Porsches offered and 13 Mercedes-Benzes, only one Mercedes-Benz failed to sell, and both outperformed their presale estimates. However, Mercedes-Benz was the stronger of the two, beating its estimates by an average of 33 percent premium versus “just” 16 percent for Porsche. Part of this was thanks to a single car—a 2005 Mercedes-Benz CLK DTM that RM Sotheby’s sold for $472,500, which was well above its $375,000 high-estimate.

2021 is the year of the restomod

We predicted in January that this would be the year restomodded versions of many American classics, including early Corvettes, surpassed original examples in value. Amelia provided backhanded confirmation of that when RM Sotheby’s sold a 1960 Chevrolet Corvette raced at Le Mans by Briggs Cunningham for $758,500. That’s less than the $825,000 Barrett-Jackson got for a restomod 1959 Chevrolet Corvette in March. Yes, the Cunningham Corvette is unrestored, but few C1s have a better pedigree. It seems that those who want early Corvette style are increasingly unwilling to live with early Corvette driving dynamics.

Better the second time around

Repeat sales were mostly strong this year, providing an apples-to-apples indication of how the market has strengthened in recent months. RM’s top sale, the 1929 Duesenberg Model J ‘Disappearing Top’ Torpedo by Murphy was nearly double the $3,000,000 the same car brought at an RM sale in 2016. A 1975 BMW 2002 Turbo at Bonhams sold for 25 percent more than the $112,200 it sold for four years ago at Amelia Island. Not everything did better: A 2006 Ford GT Heritage at Bonhams sold for six percent less than its previous $412,000 from 2018.

The classic car market isn’t back … because it never left

The strong prices at Amelia—coupled with the growth we’ve observed all year in the online auction space and in the private market—indicate that demand for collector cars has recovered from the woes 2020 and then some. Buyers are still seeking out a pandemic-proof pastime even as the pandemic appears to be winding down, with more events and travel opportunities opening. Whether this demand continues to push prices higher, and whether returning in-person auctions will be able to maintain their ground in a collector car world that has shifted online in a big way, remains to be seen. Look to Pebble Beach in August for more answers. As a (re)opening act, however, the 2021 Amelia Island auctions were very encouraging.

Hagerty Insider will have more coverage of the Amelia Island auctions, including detailed auction reports, throughout the next two weeks.