We may be entering the era of instant appreciation

On August 14, 1988, Enzo Ferrari passed away. Like a great artist experiencing a post-mortem spike in the prices of his or her work, every car with Ferrari’s name on it was now assumed to be a blue chip investment. And not just the ones built prior to Fiat’s takeover of the road car division of Ferrari in 1971. Every Ferrari—including some of the decidedly not very special cars Ferrari was building in the late 1980s—skyrocketed in value. Mondial Spiders were selling for almost double their $76,000 MSRP, if you could get one at all. I was there. I saw it. All new Ferraris were instant collectibles. Until they weren’t.

When the Japanese asset bubble burst in 1991, and millions of collector dollars were taken out of circulation, sanity abruptly returned to the vintage car market. Actual blue chip collectible cars like the Ferrari 275 GTB and Mercedes-Benz 300SL Gullwing saw sudden, massive decreases in value, but the hardest hit when the game of musical chairs ended were the speculators who paid well over list for the “instant collectibles.” They were left with what simply became difficult-to-move used cars. Case in point, even after 30 years of inflation, the average Mondial Spider today still struggles to break $40,000. But with the end of the internal combustion era just over the horizon, the rules of collecting may be changing radically—the term “instant collectible” might be in for rehabilitation.

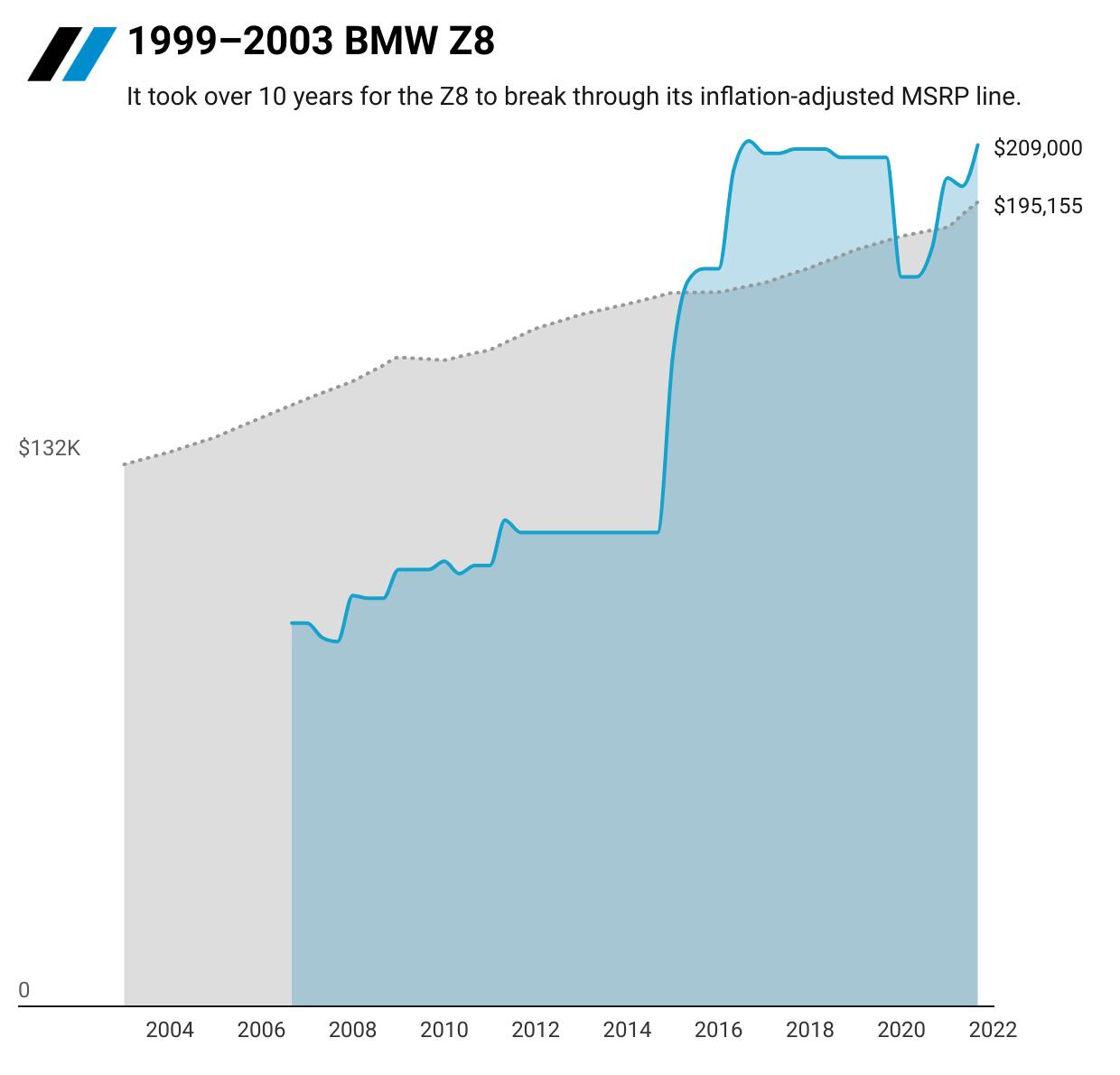

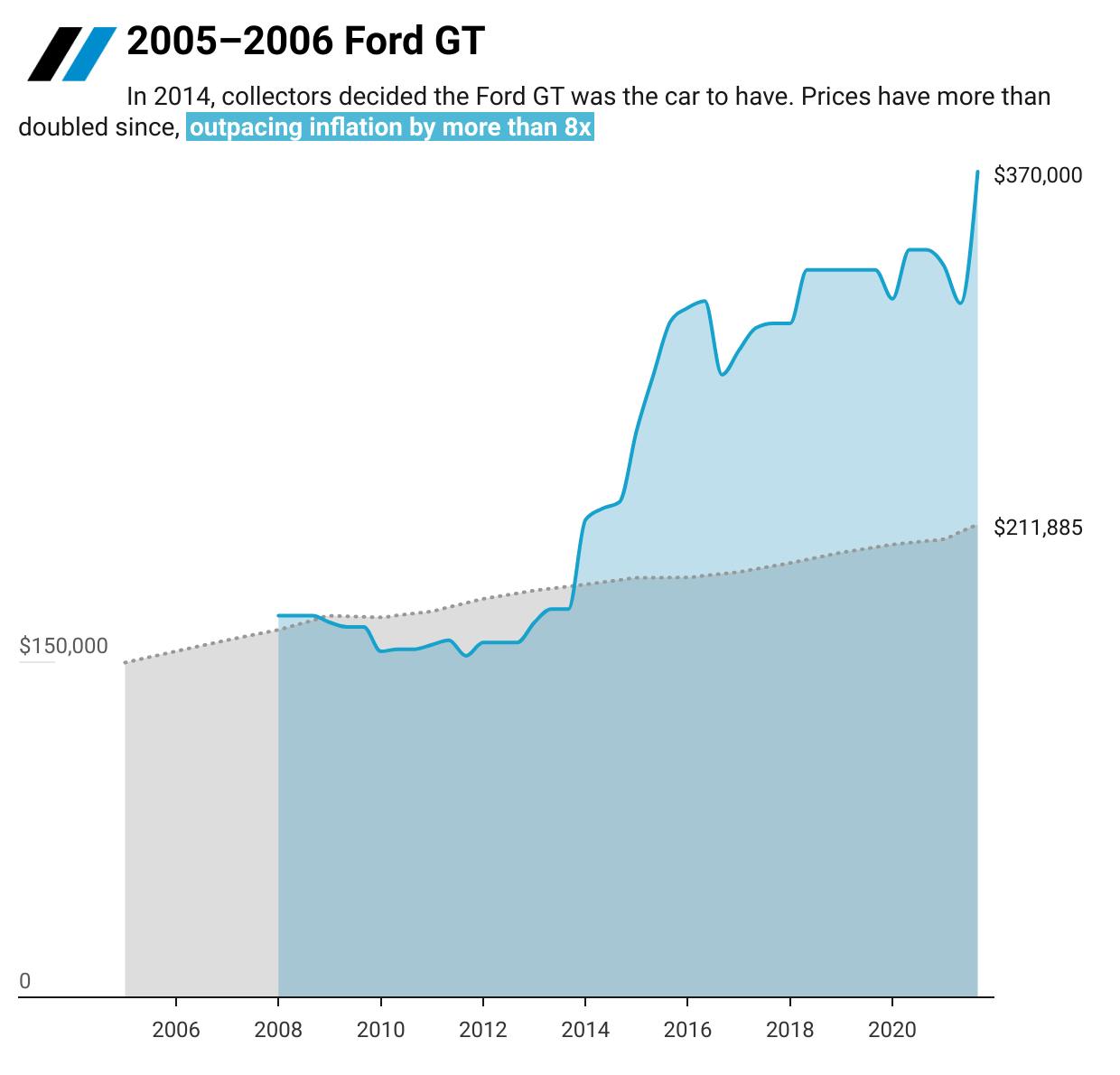

The irrational frenzy of the late 1980s tainted for a generation the notion that a modern car—no matter how great—could be considered truly collectible. The words “instant collectible” became a shady auctioneer’s cliché, carrying all of the credibility of the pitches that cryptocurrency hustlers make when they invade the comments in your Facebook newsfeed. As a result, collectors initially shied away from truly special cars like the 2005 Ford GT, the Porsche 993 Turbo S, and the BMW Z8, all of which depreciated below their original MSRPs before rising in value in comparatively recent times.

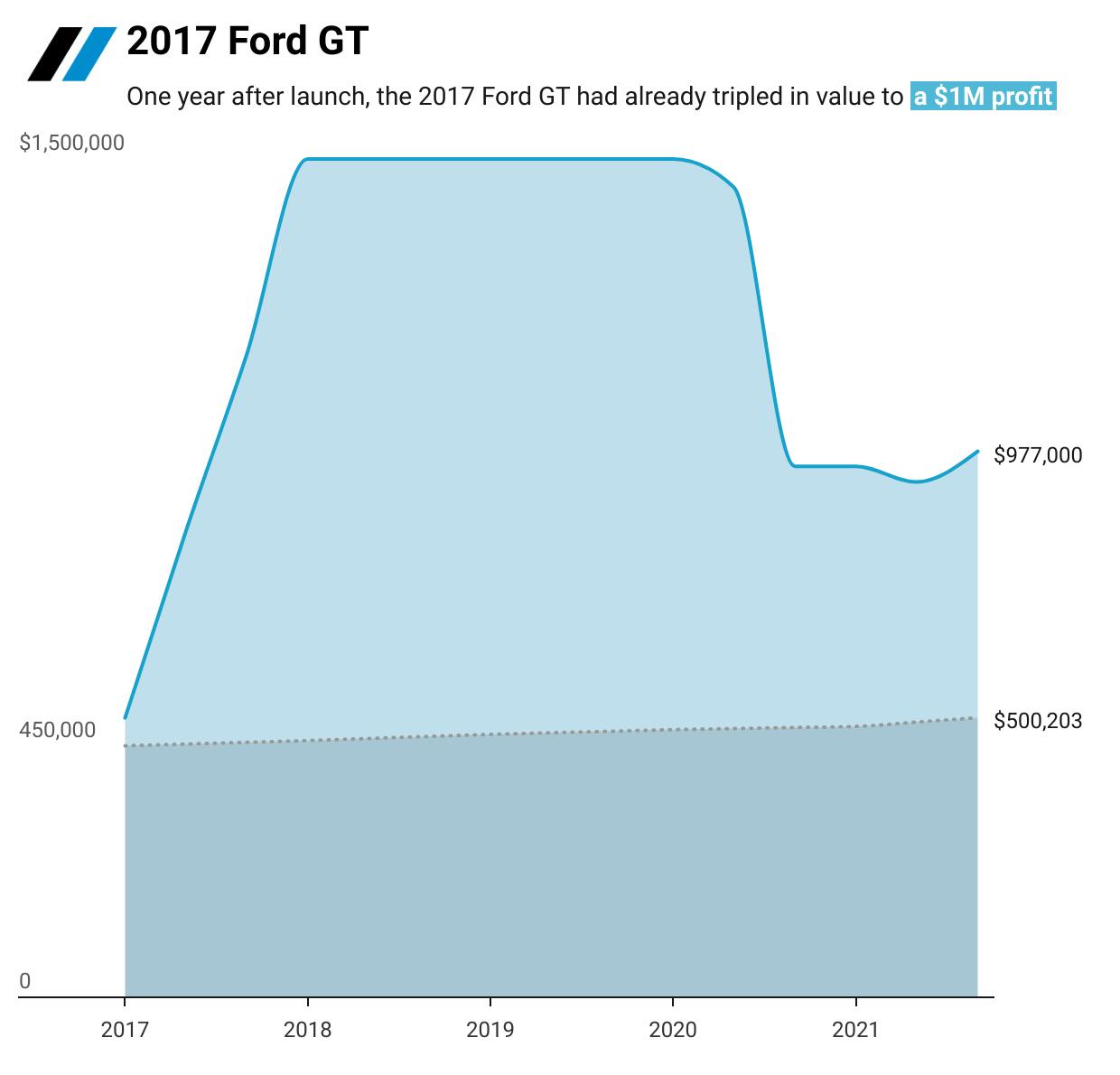

But collectors seem to be getting over that reluctance. The days of relying on the miracle of depreciation, and picking up a bargain on a low-production, late-model supercar are probably over. Even higher production cars like the Porsche 992 Turbo S, Alfa Romeo 4C, Corvette C8, and even the new 400 hp Nissan Z might actually never depreciate significantly, in fact, just the opposite might happen. As the end of the internal-combustion era draws to a close, there seems to be a growing appreciation for just how good, how fully developed, and how special the last ICE cars really are. It’s the kind of perspective that, in the past, took over a generation to develop.

Depreciation? That’s so 2008

An enthusiast on a budget could once get into a supercar simply by waiting a year or two. Nowadays, the hottest cars skip “used” and go right to “collectible.”

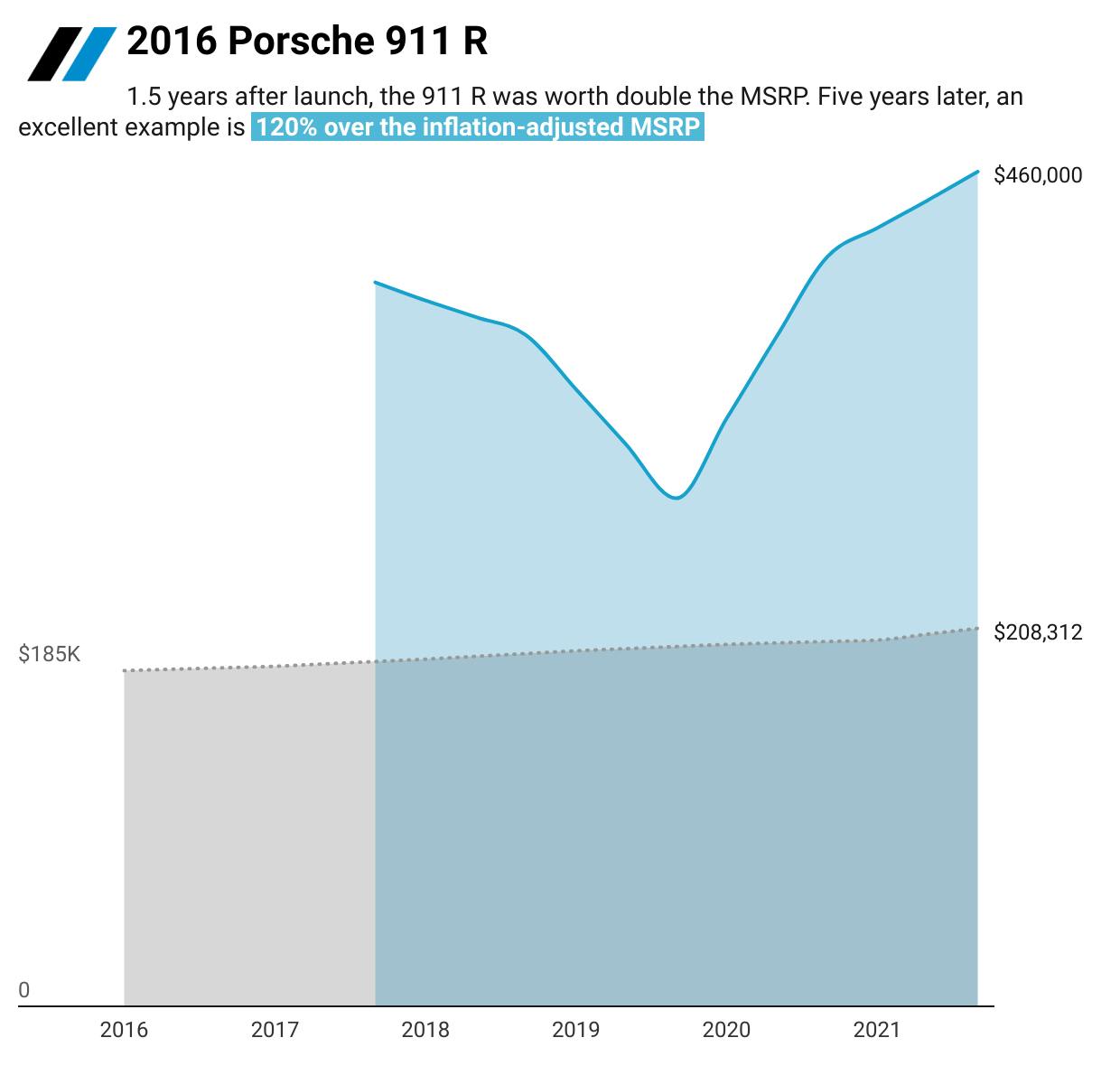

*Dotted line shows inflation-adjusted MSRP. Blue is Hagerty Price Guide value for a car in excellent (#2) condition.

As is usually the case, high-net-worth collectors seem to get the memo first. Case in point: When the 2016 Porsche 911 R was announced with an MSRP of $185,950, those who were willing to pay a premium of $100,000 or more to get one were pilloried by those who thought they knew better. When prices rose by another $100,000 or so, the haters simply couldn’t wait to revel in schadenfreude when the inevitable collapse in 911 R values came. The funny thing is, it never happened. Not even when the arguably better 911 GT3 Touring was announced. Today, ultra-low-mileage 911 Rs carry asking prices of $500,000 or so. The “fools” who jumped in and paid hefty premiums have clearly been vindicated.

What many of us mistook for an ego-driven desire to jump the line and be the first to show up at cars and coffee in a special new 911 might actually have been a brilliant case of prescience, an early recognition that the rules around special new cars from the late ICE period were changing, and that just maybe, the words “instant collectible” were no longer simply hyperbole.

***

Rob Sass is the Editor-in-Chief of Porsche Panorama, the official publication of the Porsche Club of America. The opinions stated are his, and not necessarily those of the Club.