Auction Theory: Preparing yourself for the game

For car collectors, auctions are a spectacle and a multibillion-dollar industry. For Prof. David Miller, Associate Professor of Economics at the University of Michigan, they represent something else entirely—a topic of academic study.

The field, known as auction theory, is rooted in economic study and primarily taught in higher academia. Its philosophies have solved real problems in industries like financial markets, real estate, oil, and telecommunications. Most recently, the 2020 Nobel Prize in economics was awarded to two auction theorists for their work, including creating an auction format adopted by the United States Federal Communications Commission (FCC).

That may seem far removed from whether or not to bid on that ’69 Camaro, but the principles can in fact help collectors play the game. So, we sat down with Miller to discuss auction strategy, tips for bidders, and how it informs sellers as well.

What’s it worth to you—and to everyone else?

Professor Miller suggests that bidders understand the difference between private value and common value. Private value is what a vehicle would be worth to you personally—to have, enjoy, and show off to your friends. “You shouldn’t care about the private values of other people. That information has nothing to do with what you should bid.” said Miller. If another bidder wants that Camaro because his father owned it, that might make their private value higher than yours, but it shouldn’t change your valuation of the car.

Common value, on the other hand, considers a vehicle’s objective value in a future sale. When assessing a vehicle, start by questioning the probability of its value increasing or decreasing in the future. “You should have interest in what other people think about the common value, and if they have information about it that you don’t have.”

Even the playing field

Information held by other players is a variable that many auction-goers, particularly those who are new to the scene, don’t often think about. Have others uncovered a competitive advantage by recognizing an attribute about a vehicle that’s gone unnoticed by other bidders? This involves a fair amount of sleuthing, and could include reviewing similar vehicles previously sold at auction, identifying small nuances about a vehicle’s history, or having strong data to support a bullish future market for the vehicle. After objectively determining the vehicle’s common value, studying its story, and evaluating its potential market for future sale, you’re poised to approach the auction strategically.

Once the auction begins, as a bidder you should be cognizant of your highest private value—how much you’re personally willing to pay. Your conscience and wallet will be happy knowing that you didn’t exceed your own limit. Once again, it’s important to fall back on your research of the vehicle. Ideally, you’ve selected a vehicle with a well-documented background. “The better the past information, the less you should be revising your beliefs during the auction,” said Miller.

But let’s say momentum picks up mid-auction, and the price starts exceeding what you had expected. “If the bidding seems like it’s going higher than expected, there could be two reasons. For one, other people’s private values may be higher than you expected. That shouldn’t matter to you, other than it affects the price that you have to pay. The other element is that people’s assessment of the common value may be higher than you expected because they’re bidding more aggressively than you thought they would. Probabilistically, it’s some mix of both.”

Because the bidding has crept to an unanticipated point, it’s time to reevaluate the playing field. “If bidding comes in more aggressively than you expected, you should revise your view at least a little bit upward about the common value, but not as much as the aggressiveness of the bidding. Not knowing why the other bidders are being aggressive, you should attribute some of it to their private (personal) values.”

It cuts both ways

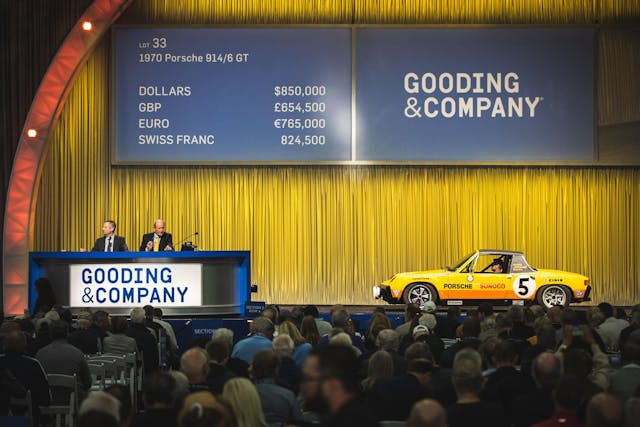

The bidder isn’t the only player in the game that could benefit from auction theory, however. Sellers frequently act strategically to maximize returns. Prior to the auction beginning, an auction house may set a minimum sale price for individual vehicles. Known as the ‘reserve’, this price must be met or exceeded for the vehicle to sell. Typically, if there is a reserve in a classic car auction, that number is not shared with bidders. As the bidding proceeds, the seller and auction house may choose to either remove the reserve or announce that the reserve has been met in an effort to eke out every last possible bid from interested parties. This is part of the psychological play—bidders can quickly get caught up in thinking “just a little more and I can have it” even if it means exceeding their original intended ceiling.

What’s more, the seller and the auction house may potentially come at cross purposes if bidding stalls close to the reserve price: the auction house wants to move the vehicle and take its commission, while the seller wants to meet their minimum threshold. In a live auction, obtaining the “right” outcome, regardless of what party you’re representing in these last-minute negotiations, requires a read of the room, how similar cars may have fared over the course of the auction, and your best-educated guess as to whether the car would fare as well if it were to “no-sale” today and put up for auction down the road.

In other scenarios, the item may be offered without reserve entirely. This implies the potential for a value (comparatively speaking) purchase and can encourage strong bidding from the outset.

Away from the auction tent

Auction theory is also applicable outside of the traditional auction setting. Consider a private sale between two people: this framework can aid in both value assessment and conducting negotiation. Through conversation, collect important information about the vehicle. Immediately distinguish the difference in the seller’s private value and vehicle’s true common value. To make sure you’re getting the best deal, negotiate and make a deal based on the latter.

One advantage of understanding auction theory is that you’ll be prepared when your competition might not be. “This is a very fun and exciting environment. If you go into that unprepared, it can be overwhelming and easier to make mistakes”, said Miller. With some planning, you’ll assess the vehicle objectively and reduce the potential for an emotionally-driven overspend.

While we acknowledge that theory alone doesn’t always hold up in practice, the principles mentioned here are quite basic. As with any new effort, take the time to understand what you’re getting into, plan ahead by doing your homework on the subject vehicles, and try to stay cool during the auction. Remember, this is a game, and you’re a player – what strategies are you playing with?

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.